Membership

Home »Help Make the World a Safer Place

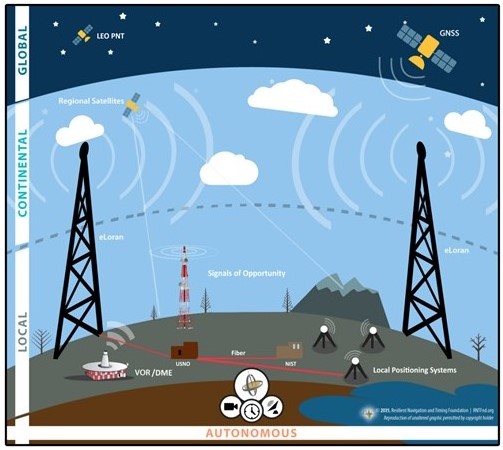

Consider how important navigation and timing services are to everyday life. Telecommunications, information technology, financial transactions, electric power distribution, transportation – all depend upon navigation and timing signals. Our goals of deterring jamming and spoofing while encouraging additional resilient services will protect critical infrastructure and make the world a safer place.

Membership and Participation Levels

Resilient navigation and timing is important to everyone. We welcome all who support the foundation’s goals as members at the “Timekeeper” level. For those who would like to support and help shape foundation policies and programs even more, our giving programs at the “Navigator,” “Founder” and “Harrison Society” levels provide those opportunities.

The RNT Foundation is a member-based, non-profit1 that protects critical infrastructure by:

- Educating the public and government leaders about the importance and vulnerabilities of navigation and timing systems

- Advocating for policies to deter spoofing and jamming

- Encouraging development and implementation of resilient terrestrial systems

Memberships and donations fund our advocacy and outreach efforts through the Grant Writer Outreach program, Resilience Council, and other programs.

| Membership Level | Price | Period | |

|---|---|---|---|

|

Timekeeper – Individuals (yearly)

|

$75.00 | Annually | Join Now |

|

Timekeeper – Individual Lifetime Membership

|

$1,500.00 | One-time payment | Join Now |

|

Timekeeper – Corporate Class 1

|

$1,500.00 | Annually | Join Now |

|

Timekeeper – Corporate Class 2

|

$1,000.00 | Annually | Join Now |

|

Navigator

|

$5,000.00 | Annually | Join Now |

|

Founder

|

$10,000.00 | $5,000 annually thereafter | Join Now |

|

Harrison Society

|

$10,000.00+ | Variable | |

|

Reciprocal Non-Profit Membership

|

Free | N/A |

1 We are incorporated as a Virginia non-profit, public benefit corporation, exempt from Federal income tax under section 501 (c) (3) of the Internal Revenue Code as a charity. Dues and contributions to the foundation are generally deductible under section 170 of the code. We are also qualified to receive tax deductible bequests, devises, transfers or gifts under section 2055, 2106 or 2522 of this code. Consult your tax advisor.